Is Pent-Up Demand Set to Surge in Canada's Housing Market Following Rate Cuts?

In the wake of the Bank of Canada's recent decision to lower interest rates by 25 basis points to 2.25%, discussions are heating up about whether this move will finally release a wave of pent-up demand in the Canadian housing market, especially in major hubs like Toronto. Mortgage experts and media outlets have been quick to predict a resurgence in buyer activity, but a closer examination of the data suggests these claims may be overstated.

Examining Expert Predictions and Media Hype

Real estate professionals and news sources, including reports from CTV News and insights from industry leaders like the CEO of Coldwell Banker, have highlighted the potential for increased investor and buyer engagement post-rate cut. However, such optimistic forecasts have echoed through the market since interest rates began rising in 2022, without substantial evidence to back them up. Relying on anecdotal commentary from social media and industry insiders often overlooks critical data-driven analysis.

A Data-Driven Look at Toronto's Housing Sales

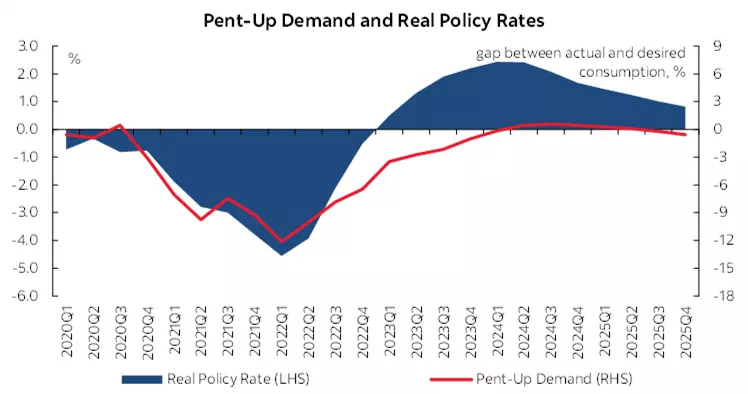

To assess the validity of these predictions, consider historical sales trends in Toronto, which offers robust data for evaluation. Over an 11-year period, the market averaged approximately 89,000 home sales annually. From 2020 to 2024, projections based on this average would anticipate 445,000 sales, yet actual figures fell short at 410,000—a shortfall of 35,000 units. Even if this deficit were to materialize in the current year, total sales would only reach about 97,000, still significantly below the peak levels seen in 2021. This analysis indicates that the notion of massive pent-up demand waiting to flood the market lacks empirical support.

Key Factors Influencing Market Dynamics

Several variables complicate the pent-up demand narrative:

- Immigration and Wage Realities: While population growth through immigration is often cited as a driver for housing demand, recent data shows that the median wage for newcomers in 2022 was around $52,000—insufficient to afford homes averaging $900,000. Additionally, rental prices in Ontario have declined to historic lows, easing pressure on the ownership market.

- Affordability Challenges: Home prices remain elevated, and even with the recent rate reduction, borrowing costs are higher than pre-2022 levels. Combined with stagnant income growth, this has pushed ownership expenses as a percentage of median income to unsustainable heights, as evidenced by indices like the RBC Home Ownership Poll.

- Economic and Geopolitical Context: Rising unemployment, potential trade disruptions between the U.S. and Canada, and broader economic shifts further dampen enthusiasm. These conditions starkly contrast with the favorable environment of earlier years, making a direct comparison to past booms inappropriate.

Drawing from economic principles, such as those outlined in MIT's theory of consumer choice, demand is inherently tied to factors like price, income, and perceived value—all of which have deteriorated in the current landscape.

Why the Pent-Up Demand Story Persists—and What It Means for Buyers

For over three years, the real estate sector, banks, and media have perpetuated the idea of dormant demand ready to awaken, potentially to instill a fear of missing out among prospective buyers. Yet, without supporting studies or data, this remains speculative at best. As we await October's real estate board reports, stakeholders should approach the market with caution, prioritizing comprehensive financial assessments over hype.

In summary, while interest rate cuts provide some relief, they are unlikely to trigger the explosive demand some predict. For those navigating Canada's housing market, staying informed with reliable data is key to making sound decisions.

If you're considering buying or selling in the Calgary, AB real estate market amid these evolving conditions, now is the time to act with expert guidance. Contact Adam Vetter at adamvetter.com today for personalized insights, market analysis, and tailored strategies to navigate interest rate changes and housing trends. Whether you're a first-time buyer or seasoned investor, let's connect to turn your real estate goals into reality—schedule a consultation and stay ahead in Calgary's dynamic market.

Categories

Recent Posts