What is an FHSA and How It Can Benefit You

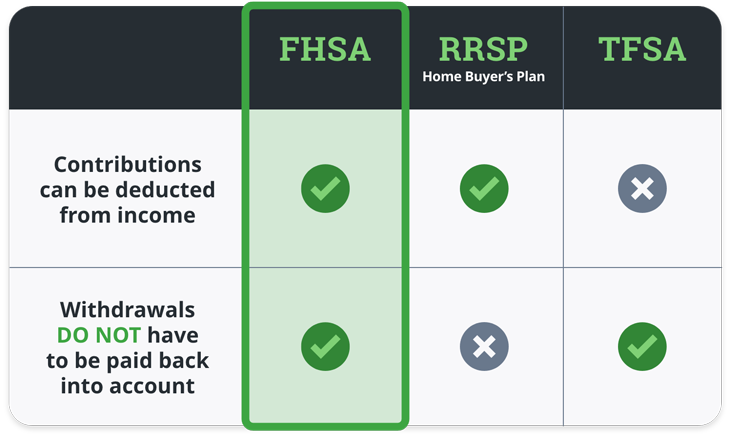

First Home Savings Account (FHSA) is a relatively new savings account introduced to help first-time homebuyers save for a down payment and other related costs in a tax-advantaged way. It combines some of the best features of both Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs), making it an excellent option for those planning to purchase their first home.

Key Features of the FHSA:

- Tax-Deductible Contributions: Just like an RRSP, contributions to your FHSA are tax-deductible. This means that every dollar you contribute reduces your taxable income, which could result in a tax refund.

- Tax-Free Growth: The money in your FHSA grows tax-free, similar to a TFSA. Any interest, dividends, or capital gains earned within the account won’t be taxed, helping your savings grow faster.

- Tax-Free Withdrawals: When it comes time to use the funds for purchasing your first home, you can withdraw the money tax-free. This is one of the most attractive benefits of the FHSA!

How the FHSA Can Benefit You:

- Save More for Your Home: The tax-free growth and deductions mean you’ll accumulate savings faster than you would in a regular savings account.

- Double Tax Benefits: With both tax-deductible contributions and tax-free withdrawals, the FHSA maximizes your ability to save for a home with minimal tax impact.

- Purchase Flexibility: You can use the funds to cover your down payment, closing costs, or other home-buying expenses, helping you achieve your homeownership goals sooner.

- Room for Growth: The FHSA allows you to contribute up to $8,000 per year, with a lifetime contribution limit of $40,000. This provides a solid foundation for your home-buying fund.

- No Immediate Time Frame for Purchase: While the FHSA is designed for first-time homebuyers, you don’t have to rush into buying a home. You can carry over your contributions for multiple years until you find the right property.

Eligibility:

To be eligible for an FHSA, you must be:

- A first-time homebuyer (meaning you haven’t owned a home in the past).

- 18 years or older.

- A Canadian resident.

Getting Started with an FHSA:

- Open an FHSA with a financial institution, such as a bank or credit union.

- Make annual contributions (up to $8,000) until you reach the $40,000 limit.

- Use the funds for your first home purchase at any time, provided the home is located in Canada.

If you’re interested in learning more about how an FHSA could fit into your home-buying plans, or if you need recommendations for where to open an account, feel free to reach out. I’m happy to help guide you through the process and answer any questions you might have.

Thank you for trusting me to be a part of your real estate journey. I look forward to helping you achieve your homeownership goals!

Categories

Recent Posts